If you would have seen my wallet several years ago you would be calling me George Costanza (Seinfeld fans will get that one). It was huge and had receipts sticking out everywhere. The fun was every time I sat down to “balance” the checkbook and it took hours to organize everything. That’s bad enough when you’re talking about a personal bank account but when you are talking business you had best have things organized.

So when I started my freelancing/consulting business I knew I had to do a better job of managing and tracking my finances. This is when a friend told me about ClearCheckbook.com a website which acted as an electronic bank register. The cool thing is that it has an Android and iOS version to work with the web based version.

ClearCheckBook

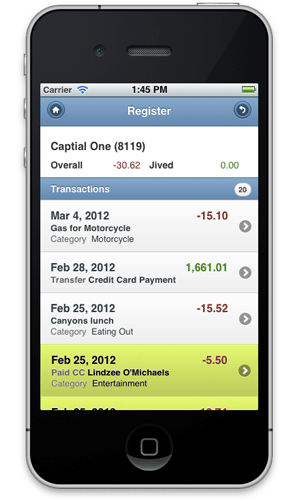

So what makes ClearCheckBook so attractive to me? The simplicity is what I love. There is no live connection to your bank account. So you don’t have to worry about security. ClearCheckBook is simply an electronic register (with bells and whistles). You can set up multiple accounts and then you simply enter your transactions just as you would in a paper register. I no longer forget to record that $87.34 gas fill up because now I do it in the car on my phone as soon as I get in.

ClearCheckBook has the ability to categorize your expenses so that you can see exactly where the money is going. The custom category feature has been a great tool for me. I set up a special category whenever I am taking a specific business trip or family vacation. Then I assign all expenses on that trip to the category. I can then get a quick report on how much I spent on the trip.

Here are the specific features of the iOS and Android versions:

- It’s completely free!

- View your balances at a glance

- Quickly add and view your transactions

- Ability to manage your accounts and categories

- Very light weight – loads extremely fast

- Stay logged in to quickly manage your accounts

- Ability to log out for privacy

- Manage your budget with spending limits

- View reports on your spending and saving

ClearCheckBook lets you set up recurring transactions that post automatically on a schedule you set. You can also put all of your bills in the bill tracker feature and see what you have due. There is even a debt snowball feature in ClearCheckBook that helps you pay down your debt faster.

One way that ClearCheckBook has helped me is that we run a report every month that shows spending by category. This has shown us where our money is going and helps us to stay on budget better. Before ClearCheckBook we used a paper register that honestly never quite balanced out. But now I balance it down to the penny each time I sit down with it (usually a couple times a week).

There are free and paid accounts. I use the free account but you get more features with the paid such as multiple users, running balances, and lot more.

I think ClearCheckBook is a great service and the mobile apps are useful and extend the functionality of the service.